Key Features of ZATCA Approved E-Invoicing Solutions

Key Features of ZATCA Approved E-Invoicing Solutions

Blog Article

With the Saudi Arabian government’s mandate for electronic invoicing, businesses in the Kingdom are required to adopt e-invoicing solutions approved by the Zakat, Tax and Customs Authority (ZATCA). This shift aims to enhance the efficiency, transparency, and accuracy of tax-related transactions. Understanding the key features of ZATCA approved e-invoicing solutions is essential for businesses to ensure compliance and streamline their invoicing processes. This blog will delve into the crucial elements that define the e-invoicing in Saudi Arabia.

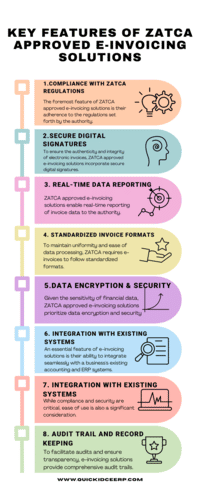

Here are the Key Features of ZATCA Approved E-Invoicing Solutions

1. Compliance with ZATCA Regulations

The foremost feature of ZATCA approved e-invoicing solutions is their adherence to the regulations set forth by the authority. These solutions are designed to meet all technical and procedural requirements mandated by ZATCA, ensuring that businesses can generate and store invoices in a compliant manner. Compliance includes the format of the invoices, mandatory fields, and the secure transmission of invoice data to ZATCA.

2. Secure Digital Signatures

To ensure the authenticity and integrity of electronic invoices, ZATCA approved e-invoicing solutions incorporate secure digital signatures. These digital signatures verify the identity of the issuer and protect the content of the invoice from tampering. This feature is critical for maintaining trust and legal validity in electronic transactions.

3. Real-Time Data Reporting

ZATCA approved e-invoicing solutions enable real-time reporting of invoice data to the authority. This feature ensures that all transactional data is immediately available to ZATCA, enhancing transparency and reducing the risk of fraud. Real-time reporting also facilitates timely VAT settlements and compliance checks.

4. Standardized Invoice Formats

To maintain uniformity and ease of data processing, ZATCA requires e-invoices to follow standardized formats. Approved solutions ensure that all invoices are generated in these prescribed formats, which include specific fields such as VAT numbers, invoice dates, and amounts. Standardization simplifies the verification process and ensures consistency across all invoices.

5. Data Encryption and Security

Given the sensitivity of financial data, ZATCA approved e-invoicing solutions prioritize data encryption and security. These solutions use advanced encryption protocols to protect invoice data during transmission and storage. Secure handling of data helps prevent unauthorized access and ensures that sensitive information remains confidential.

6. Integration with Existing Systems

An essential feature of e-invoicing solutions is their ability to integrate seamlessly with a business's existing accounting and ERP systems. This integration allows for the automatic generation, submission, and storage of electronic invoices, minimizing manual intervention and reducing the risk of errors. Businesses can maintain their current workflows while complying with ZATCA requirements.

7. User-Friendly Interface

While compliance and security are critical, ease of use is also a significant consideration. ZATCA approved e-invoicing solutions offer user-friendly interfaces that make it easy for businesses to create, manage, and submit electronic invoices. This user-centric design ensures that businesses can quickly adapt to the new system without extensive training.

8. Audit Trail and Record Keeping

To facilitate audits and ensure transparency, e-invoicing solutions provide comprehensive audit trails. These trails record all actions related to the creation, modification, and transmission of invoices. Additionally, solutions ensure that electronic invoices are stored securely for the legally required duration, typically five years, as mandated by ZATCA.

9. Multilingual Support

Given the diverse business environment in Saudi Arabia, many e-invoicing solutions offer multilingual support. This feature ensures that users can operate the software in their preferred language, enhancing usability and compliance across different segments of the workforce.

10. Automated Error Detection

To minimize compliance risks, ZATCA approved e-invoicing solutions come equipped with automated error detection features. These features identify and flag discrepancies or missing information in real-time, allowing businesses to correct errors before submission. This proactive approach helps maintain the accuracy and reliability of invoice data.

Benefits of ZATCA Approved E-Invoicing Solutions

The implementation of ZATCA approved e-invoicing solutions offers numerous benefits for businesses in Saudi Arabia:

1. Enhanced Compliance: Businesses can easily comply with ZATCA regulations, avoiding potential fines and legal issues.

2. Increased Efficiency: Automated invoicing processes reduce manual workload and streamline operations, allowing staff to focus on more strategic tasks.

3. Improved Accuracy: Standardized formats and automated error detection minimize the risk of errors, ensuring accurate and reliable financial data.

4. Greater Transparency: Real-time reporting and comprehensive audit trails enhance transparency in financial transactions, building trust with stakeholders.

5. Cost Savings: By reducing paper-based processes and manual interventions, businesses can achieve significant cost savings.

Choosing the Right E-Invoicing Solution

Selecting the best ZATCA approved e-invoicing solution for your business involves considering several factors:

1. Compatibility: Ensure the solution is compatible with your existing accounting and ERP systems.

2. Scalability: Choose a solution that can grow with your business, accommodating increased transaction volumes and user numbers.

3. Support: Opt for a provider that offers robust customer support, including training and technical assistance.

4. Reputation: Consider the reputation and track record of the e-invoicing solution provider in the market.

5. Cost: Evaluate the total cost of ownership, including setup fees, subscription costs, and any additional charges for extra features or users.

Conclusion

Adopting a ZATCA approved e-invoicing solution is not just a regulatory requirement but a strategic move that can significantly enhance your business operations. By understanding the key features and benefits of these solutions, businesses in Saudi Arabia can make informed decisions that ensure compliance, improve efficiency, and foster growth. Embrace the digital transformation of invoicing to stay ahead in the competitive business landscape of Saudi Arabia.